Back in April, we took a deep dive into our motivations. As followers of Christ, we shouldn't be chasing applause or recognition from the world. Instead, our eyes should be focused on seeking God's approval and His reward. This month, we're going to be taking it a step further. It's

You may have a hard time believing it based on the stock market's reaction, but the May Jobs report was not an overwhelmingly positive development for the stock market. The gains on Friday swung the S&P 500 back into positive territory for the week and has it within

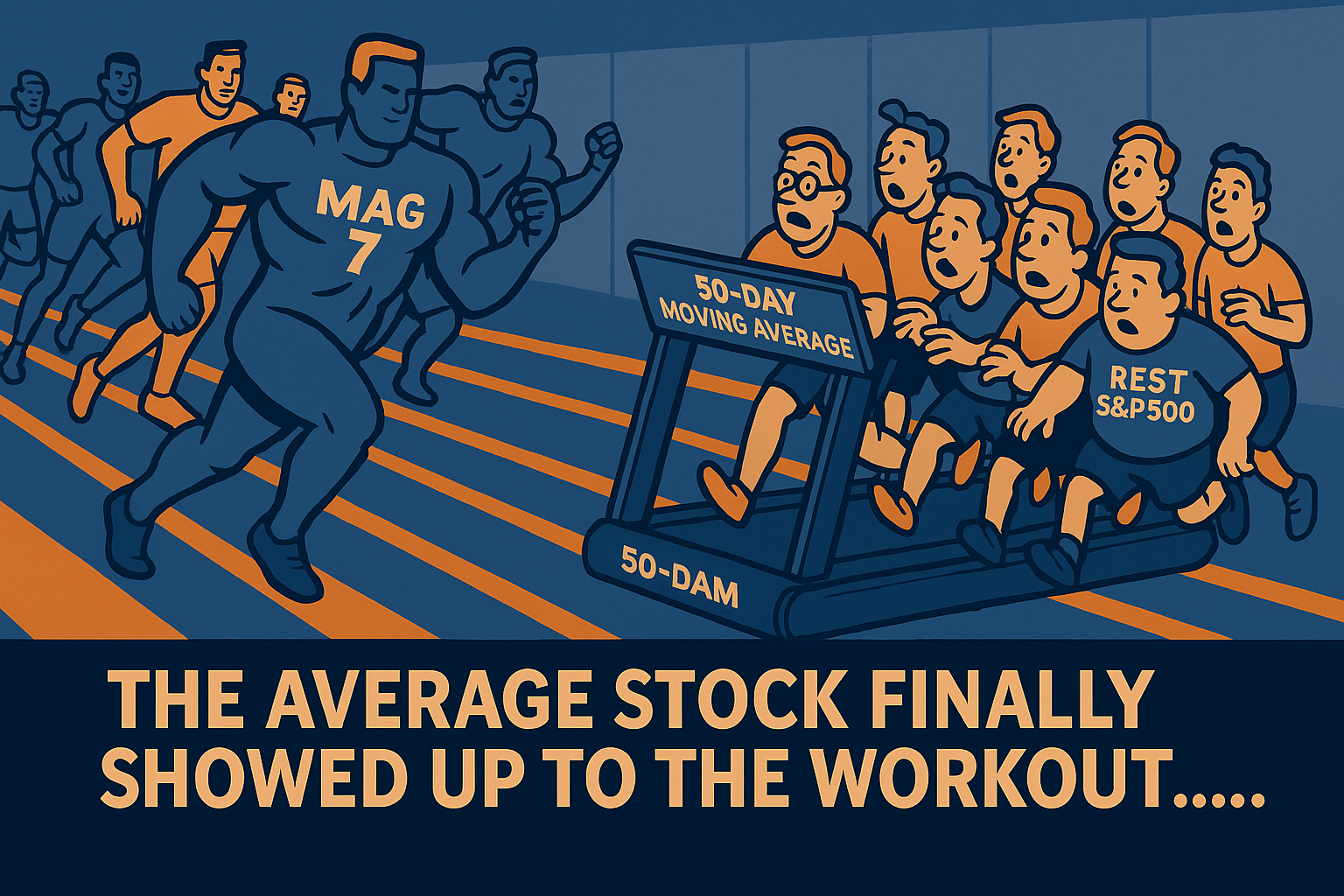

There were many times in 2023 & 2024 where I sat down to write the blog and I thought, "how many different ways can I say the same thing?" Back then it was all about the mega cap stocks (eventually named the "Magnificent 7" or "Mag 7") and how they

We spent the first quarter of the year looking at part 1 of Every Good Endeavor, which focused on God's design for work. If you missed any of those blogs, you can find them all here. We're now going to shift to part 2 of the book, "Our Problems with

For the first time since the election I decided to take a weekend to NOT read about anything related to the stock market, economy, or politics. Unfortunately because of the latter playing a key role in the markets my attempt to completely ignore everything market related was thwarted. Since we're